Boost Your Energy Resiliency!

At California Solar, we strongly believe that solar and battery backup systems are most effective when used in tandem. When combined, these systems provide a highly reliable source of energy, cost savings, and peace of mind that you won't get from either system alone.

Our dedicated team is committed to helping homeowners like you to reap the full benefits of this powerful energy solution. We'll work with you to evaluate your energy needs, develop a customized solar and battery backup system combination, and ensure that it's installed with care and precision.

With our solutions, you won't have to choose between solar or battery backup - you can have both and enjoy greater energy resiliency and cost savings. Get started today with a free evaluation, and take the first step towards an energy solution that really works for you.

See What Are Customers are Saying about us

ARE YOU READY TO GO SOLAR?

We’re beyond excited to begin this journey with you! We’re here to help you achieve all your goals for energy resilience.

the first ever worker-owned solar CO-OP in california

Local Power, Local People!

Our team of worker-owners is dedicated to offering you the best education about your solar options. With two decades of experience in design and installation, we are YOUR local solar experts!

Residential

Solar plus battery backup systems offer numerous benefits for your home and family, including:

Reduced carbon footprint.

Lower PG&E bills.

Increased home value.

Reliable battery backup for power outages.

Commercial

Switching to solar energy can be a smart move for your business, farm, or organization. Here are just a few benefits that commercial solar clients can expect to enjoy:

Access to clean, renewable energy.

Potential tax and depreciation incentives.

Increased property value.

Excellent return on investment.

Significantly reduced PG&E bills.

By making the switch to solar, your business can not only reduce its environmental impact but also take advantage of numerous financial benefits. Our team is here to help you explore your solar options and develop a customized solution that meets your unique energy needs. Get in touch today to learn more!

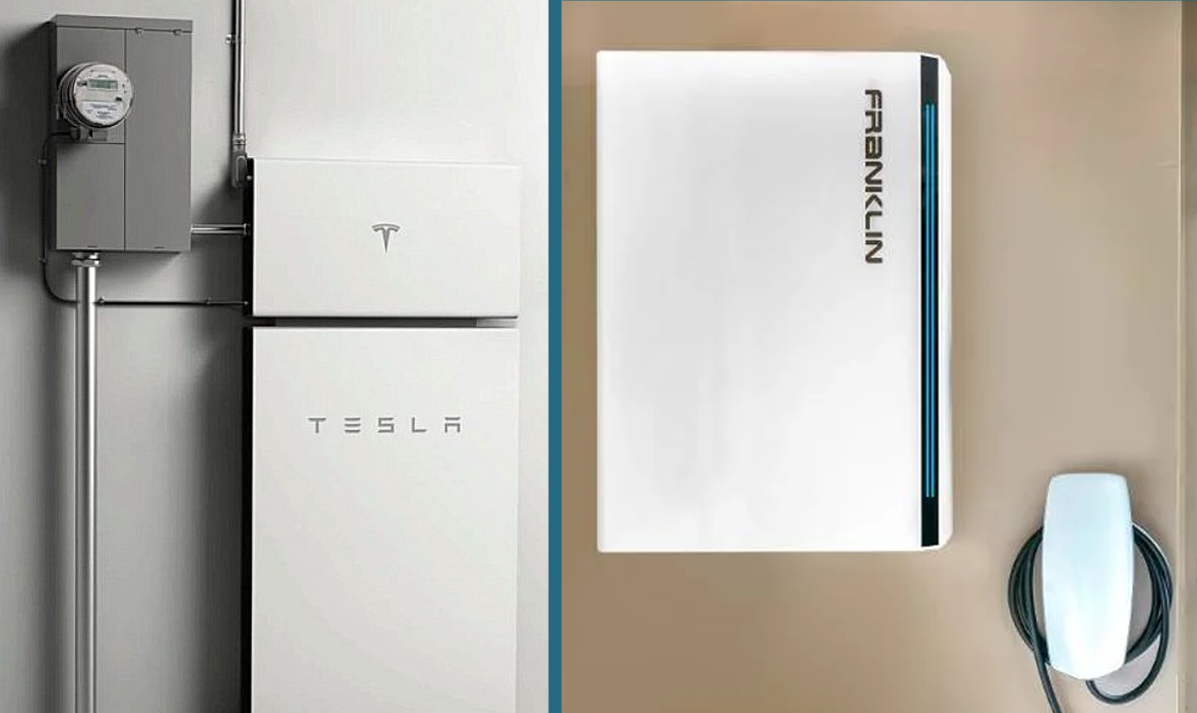

BATTERY STORAGE

Battery storage is an increasingly popular solution for homeowners and businesses looking to boost their energy resiliency and reduce their dependence on the grid. At California Solar, we're proud to offer top-of-the-line battery storage options from industry leaders like Tesla, Enphase, and FranklinWH. These trusted brands provide advanced technology and reliable performance, making them an excellent choice for backup power and reducing energy costs. Whether you're interested in adding battery storage to an existing solar system or exploring solar and battery storage options together, our team can help. We'll work with you to assess your energy needs and develop a customized solution that maximizes your energy resiliency and minimizes your costs.

WHAT OUR CUSTOMERS SAY

“I’m impressed that California Solar is local. They’re very thorough and very knowledgeable. Of course, Brandon and Rob could answer any question we had about how it works and what the options were for financing and what the best strategy is for making use of solar. I do like going out to our meter and having air conditioning running, and see that we’re still pumping electricity back to PG&E. I like that.” - Dave (Nevada City)

“We switched to solar because we wanted to ensure that our electric bills would not increase in the future. We chose Cal Solar because, from the beginning, we were impressed with the knowledge and speed in which our questions were answered. We tell everyone we know to use Cal Solar!” - Justin and Wendy (Grass Valley)

“Last fall a California Solar Representative had a table outside of Briar Patch. He followed up, answered my myriad of questions, and was very helpful to me in making a decision to go with California Solar. I had several other estimates done right around the same time but felt that California Solar would give me the very best plan. The financing was made quite easy thanks to Michael. I am very eager to watch the return on my investment in the future.” - Dee Ann (Nevada City)

California Solar Installations Map